Small Finance Bank License

Small Finance Bank License

How to apply for Small Finance Bank License?

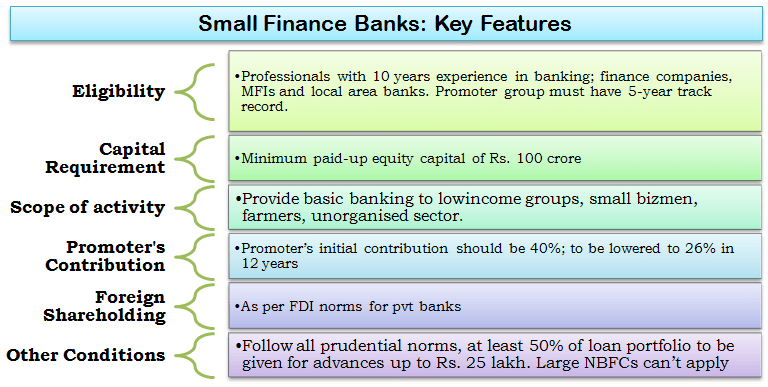

Small finance bank shall be registered as a public limited company under the Companies Act, 2013 and will be licensed under Section 22 of the Banking Regulation Act, 1949 and governed by the provisions of the Banking Regulation Act, 1949 and Reserve Bank of India Act, 1934 and with other relevant Statutes and the Directives/Regulations and other Guidelines/Instructions issued by RBI and other regulators from time to time.

Reserve Bank of India wants to serve rural & semi-urban areas such as small businesses, unorganized sector, low-income households, farmers and migrant workforce through Small Finance Banks.

Small finance banks are a type of niche banks. These type of banks carrying small finance bank license provides basic banking services related to acceptance of deposits and lending. Their main aim is to provide financial services to those sections of the economy which are not being served by the other banks, such as small business units, small and marginal farmers, micro and small industries and entities of the unorganized sector.

Small Finance Banks make money by collecting money from current account & saving account depositors, fixed depositors, commercial papers, Wholesale deposits, refinancing etc. On saving account they offer interest rates between 6 to 7 % subject to conditions. On fixed deposit around 9%, interest is offered. SFBs offers two types of products such as group loans & individual loans. These products can be further divided into agricultural, education, home improvement, home purchase, livestock loans etc.

SFBs do not get a guarantee against the loan offered. In the group loans, they are offered on the joint liability. In case any member of the group does not pay than the whole group is held liable for the same.

Small Finance Banks require prior approval for the opening of bank branches from RBI. Universal banks do not require such permission for roll out a branch in the unbanked rural areas.

Small Finance Banks required to extend 75% of their Adjusted Net Bank Credit (ANBC) to the classified sectors under priority sector lending (PSL) by the RBI. Agriculture, Small scale industries, Small business/ service enterprise, Microcredit, Education loans.

Small Finance Banks make money by collecting money from current account & saving account depositors, fixed depositors, commercial papers, Wholesale deposits, refinancing etc. On saving account they offer interest rates between 6 to 7 % subject to conditions. On fixed deposit around 9%, interest is offered. SFBs offers two types of products such as group loans & individual loans. These products can be further divided into agricultural, education, home improvement, home purchase, livestock loans etc.

SFBs do not get a guarantee against the loan offered. In the group loans, they are offered on the joint liability. In case any member of the group does not pay than the whole group is held liable for the same.

Small Finance Banks require prior approval for the opening of bank branches from RBI. Universal banks do not require such permission for roll out a branch in the unbanked rural areas.

Small Finance Banks required to extend 75% of their Adjusted Net Bank Credit (ANBC) to the classified sectors under priority sector lending (PSL) by the RBI. Agriculture, Small scale industries, Small business/ service enterprise, Microcredit, Education loans.What is OBJECTIVE of Small finance bank?

- Its primary purpose is to provide an institutional mechanism for promoting rural & semi-urban savings and also providing credit for viable economic activities in local areas and provision of savings vehicles primarily to unsaved and underserved sections of the population, and

- Supply of credit to small business units; small and marginal farmers; micro and small industries; and other unorganized sector entities, through high technology-low cost operations.

What are RULES & REGULATIONS for Small finance banks?

- Small finance bank will undertake basic banking services of acceptance of deposits and lending to unsaved and underserved sections.

- It will provide banking facilities to boost saving habits.

- It will mainly target small business units, marginal farmers and unorganized sector entities through high technology-low cost operations.

- They are established as a public limited company in the private sector which is promoted either by individuals, corporate, trust or societies.

- They are governed by the provisions of Reserve Bank of India act 1934, Banking Regulation act 1949 and other relevant statutes.

- Small finance banks are considered as non-scheduled banks and they are not allowed to borrow funds from the Reserve Bank of India like other scheduled banks.

What is minimum capital adequacy requirement for Small finance bank License?

| Particulars | % |

| Minimum Capital Requirement | 15% |

| Common Equity Tier 1 | 6% |

| Additional Tier I | 1.5% |

| Minimum Tier I capital | 7.5% |

| Capital Conservation Buffer | Not Applicable |

| Pre-specified Trigger for conversion of AT1 | CET1 at 6% up to March 31, 2019, and 7% thereafter |

Key CHALLENGES faced by Small finance bank?

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex