An applicant seeking to act as a Portfolio manager can make an application to the Board in Form A along with the non -refundable application fees of Rs. One Lakh.

Portfolio Manager Registration License

Portfolio Manager Registration License

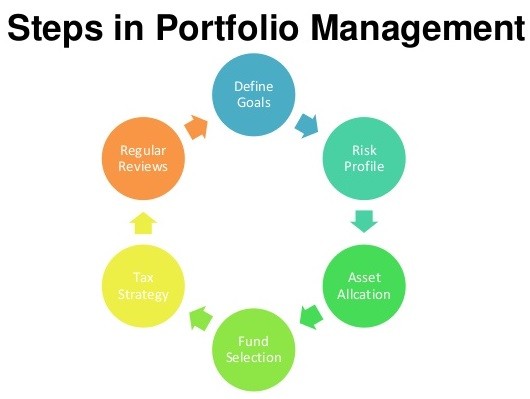

The term portfolio means a collection of investments. Therefore, the person responsible for managing, advising, supervising a portfolio, on behalf of his client, in return for a fee, is known as Portfolio Manager.

The foremost expectation from a portfolio manager is he must be capable of satisfying his client's needs by investing his funds for optimum profits. He should act in a fiduciary capacity in respect of client's funds. He should act within a framework of an agreement entered between them. The concept of a portfolio manager is governed by the SEBI (Portfolio Managers) Regulations, 1993. Therefore, it is mandatory for any individual before carrying out the activities of a portfolio manager to be registered with SEBI

Procedure for the SEBI Registered Portfolio Manager

After the receipt of the application, the Board, if not satisfied due to the incompleteness in the application and its non-confirmation to the instructions as specified in the form, then it may reject the application. The Board may also ask for the further information or even require the applicant or principal officer to appear in person before the Board.

While granting the Certificate of Registration, the Board takes into the consideration the following important points:

The applicant should be a body corporate and should have adequate infrastructure office space, equipment.

The principal officer should have qualification in finance, law and as well as should have an experience of 10 years in related activities in securities market

The applicant must have in its employment minimum of two persons, with one of them having at least five years of experience in related activities.

The activities of the Portfolio Manager should always be in the interest of investors.

The Board, as per the criteria determined in the second schedule, shall acknowledge about the fit and proper condition of the concerned individuals and the applicant entity.

Capital adequacy requirement should not be less than the net worth of Two crore rupees.

Once, the Board is satisfied that the applicant fulfills the eligibility criteria determined by the regulation, it shall send the intimation to the applicant and on receipt of the payment of fees of Rs. Ten Lacs shall grant a certificate of registration in Form B.

The certificate of Registration remains valid unless it has been suspended or canceled by the Board.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex