International Tax Advisory

International Tax Advisory

If you are carrying on operations across borders or turning a competition in multiple jurisdictions, then you have complied with the tax laws including statutory compliance as per the statutory requirements – you need to be updated with new legislative developments – it will be challenging job for your tax professionals

In the world of intensified globalized competition, the key to success of the business is plan a tax strategy and align your implementation with your planned corporate tax strategy

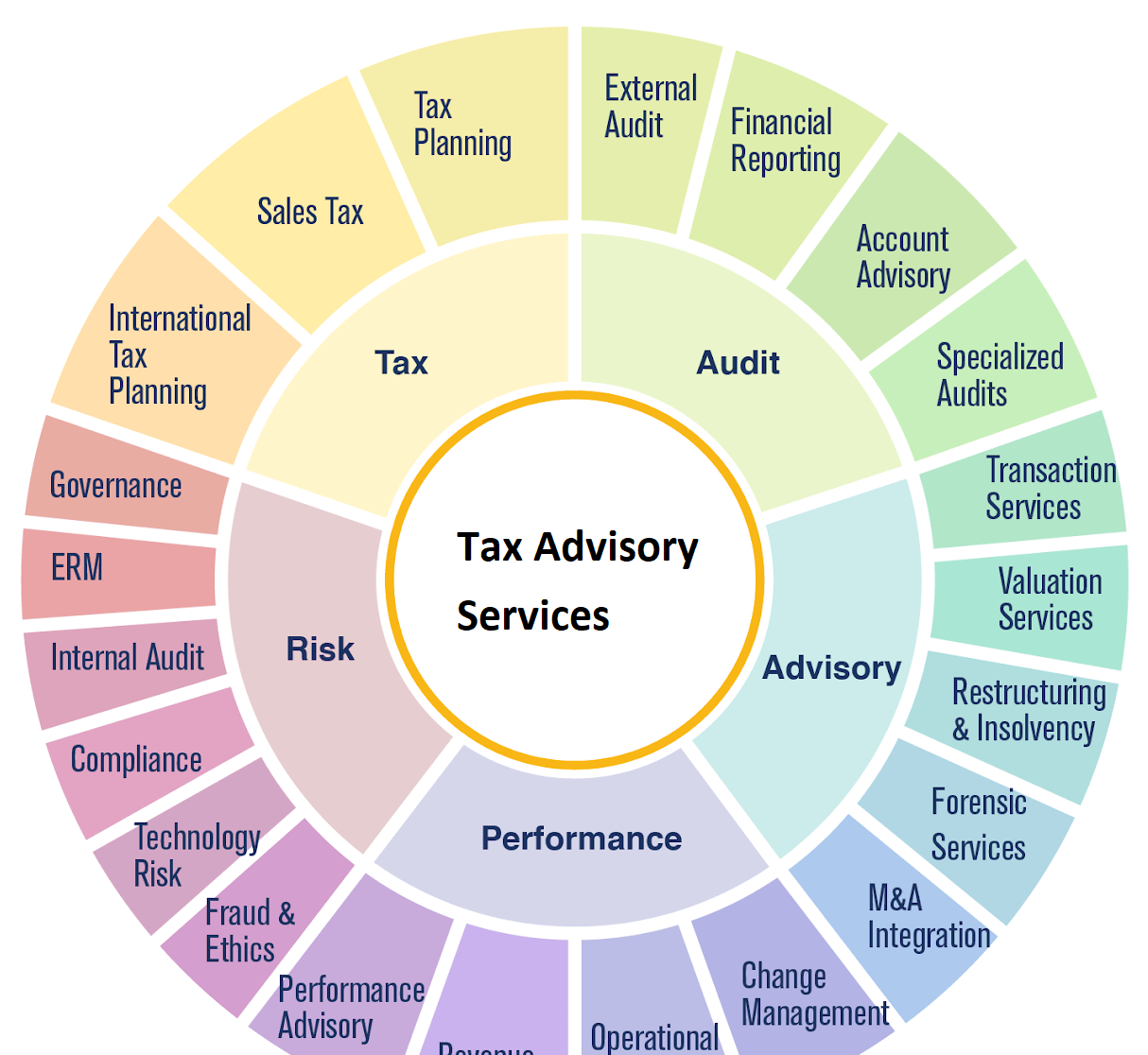

PNJ Group International Taxation Services its coverage and experience

Our tax professionals based internationally have the resources, relevant experience and competency to help the companies to address the following transactions:- Cross Border needs

- Legal Compliance

- Transfer pricing transactions

- Other tax issues

- EU Direct Tax Group

- Latin American Tax Group

- International Tax Desks

1) EU Direct Tax Group:

EUDTG is a Pan European network which mainly involves Law experts which specializes in the area of direct taxes. One will be required to be updated to cope up with the changes and explore their activities ,opportunities and investment decisions

Contents of EUDTG:

- EUDTG News alerts: It is designed to keep up to date on landmark decisions and opinions which also includes national developments in the area of direct taxation.

- EUDTG Bimonthly Newsletter: It is the summary of all the relevant ECJ and national court decisions and judgments which are related to direct tax laws and state aid.

2) Latin American Tax Group:

Latin America's continued the growth and stability makes it an attractive region for Multinationals for contemplating business and expanding an existing presence. LATAX has a core team with deep technical, business and cultural expertise in Pan regional Latin American tax issues throughout America

Our core team provides critical services as follows:

- Mergers, acquisitions, and dispositions

- Structuring new operations in a new region

- Financing the Latin American operations

- Tax treatment related to cross border transactions including deductibility, withholding taxes

- Regional shared service centers

- Holding company structures for various regions

- Limited service risk models containing contract and toll manufacturing and limited risk distribution

3) International Tax Desks:

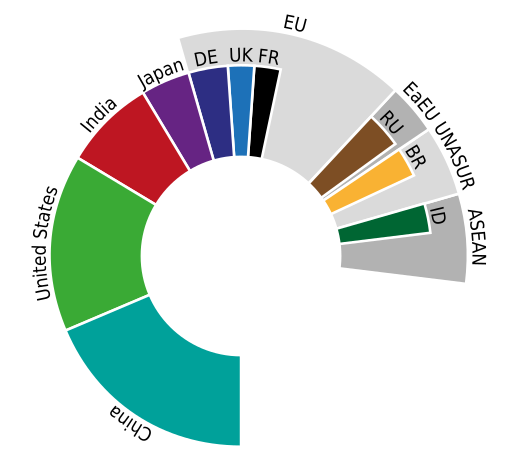

Our International Tax Desks includes experienced tax professionals from Europe, Latin America, Asia, and Africa with specific tax and business knowledge required for exploring new opportunitiesGlobalized Research and Development

Innovative and new entrants play a very crucial role in the nation’s economy – which may help to get grants and tax incentives to encourage investment from outside the nation. Our team of R&D professionals guide to identify and document t=research expenditures. Thus the team of international specialist help the multinational to take advantage of tax incentives, identify the effect of transfer pricingand formulate the corporate strategy for cross border transactions

Our team of R&D professionals guide to identify and document t=research expenditures. Thus the team of international specialist help the multinational to take advantage of tax incentives, identify the effect of transfer pricingand formulate the corporate strategy for cross border transactions

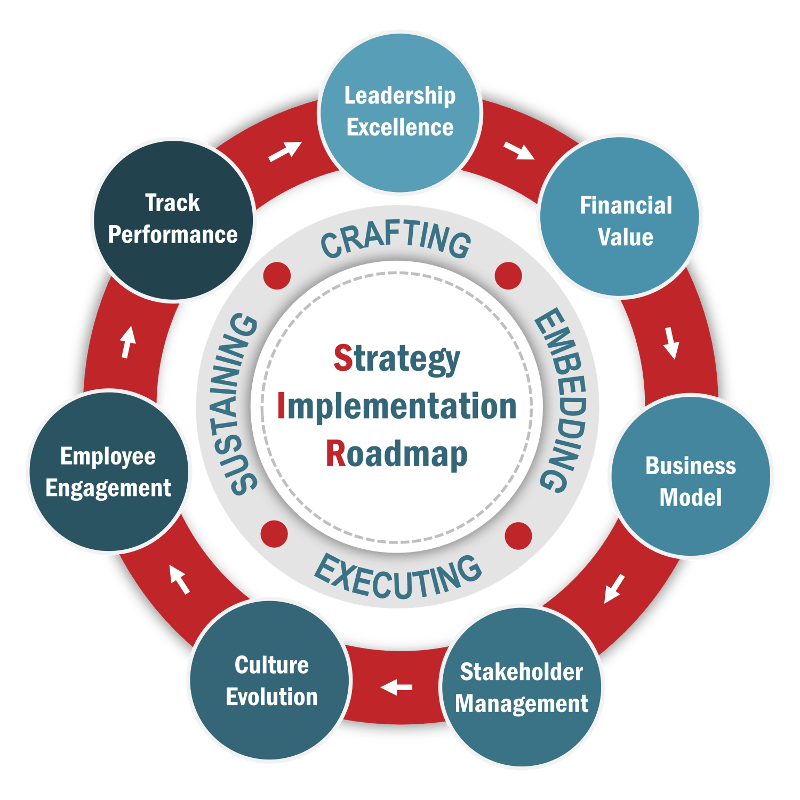

Roadmap to implementing the strategy is as follows:

- Identify the research activities

- Verify the detailed accounting records to find out the cost for availing the tax relief

- Consider existing and potential and alternative tax planning strategies based on the different jurisdictions

- Gathering, organizing and developing documents to support and reduce eligible costs

- Develop procedures , technologies which will enable to improve the efficiency and effectiveness for current and future incentives

What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex