Fraud & Misconduct Investigation

Fraud & Misconduct Investigation

Potential fraud and misconduct incidents are generally sensitive especially when they relate to insider threats or employees. Hence, organization tends to treat carefully about investigating any incident especially at countries with strong industrial actions.

The significant risk of bribery, corruption and even embezzlement of funds are normally done through accounting entries which are entered on holidays. This is the common type of fraud committed in most of the organizations

What is Audit Fraud?

In addition to their primary role, an auditor is required to consider the potential for audit fraud, in accordance with the respective auditing standards of different countries around the world.

The primary responsibility for the prevention and detection of fraud rests with those charged with the governance of the entity (i.e., the Board of Directors) and management (the client). It is mainly management’s role to place a strong emphasis on fraud prevention, which can severely reduce opportunities for corporate misdeeds.

”Fraudulent Financial Reporting”

Committed by the organization

Usually perpetrated by senior management (CEO, CFO, COO)

Benefits the organization/company

Auditor are highly concerned about this

”Misappropriation of Assets”

Usually perpetrated by lower level employees

Committed against the organization

Benefits the individual/employee

Rarely material and less of a concern for an auditor

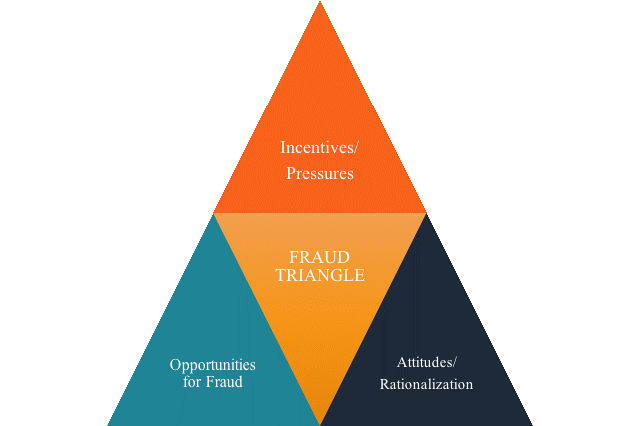

The Audit Fraud Triangle

The fraud triangle refers to conditions that are generally present when material misstatements due to fraud occur.

Incentives/Pressures

- Generally, refers to companies undergoing excessive pressure to meet analysts’ or investors’ expectations

- Stock options and bonuses based on net income are examples of such incentives and/or pressures

Opportunities for Fraud

- Ineffective governance – for example, the Board of Directors is not committed to ethical policies and morals

- Significant judgment/estimates are involved in accounting

Potential Problems arising from Attitudes/Rationalization

- Management is very aggressive, has a risk-taking mentality, and makes highly unrealistic forecasts that need to be met

- The ethical tone at the top is poor, which allows perpetrators to rationalize their actions

The Auditor’s Role

When the auditor is considering the potential for fraud in an audit, they will focus on risk assessment procedures in the planning stage. Remember that auditors must maintain an attitude of professional skepticism. One of the auditor’s responsibilities include asking management and the audit committee if they know of any unusual situation or any employee who is acting strangely, because the prevention and detection of fraud is ultimately their responsibility.

Fraud isn’t just about catching unusual transactions and relationships in the numbers in the books but also about examining the general behavioral patterns of employees and any hardships, financial or otherwise, that they may be suffering at the time.

In addition, the auditor will consider the fraud triangle and look for any fraud risk factors (red flags) that indicate an incentive/pressure to commit fraud. Finally, in the planning stage, auditors will also carry out ratio and trend analyses to look for any unusual patterns or unexpected results in relation to previous year/industry data.

The Auditor’s Responses to Audit Fraud Risks

An auditor’s action in response to potential fraud can be divided into an overall (i.e., financial statement level) and then a more specific (specific line item/assertion level) response.

In dealing with significant fraud risks at the overall level, the accounting firm will assign more experienced audit staff to the engagement and increase the level of supervision of lower level staff. The auditor will also thoroughly consider the client’s accounting choices and policies to determine acceptability. Finally, auditors may choose to implement unpredictable, surprise procedures to verify the values on the financial statements – such as unexpectedly showing up at the client’s inventory count unannounced.

On a more specific level, auditors will make an effort to gain more reliable evidence by relying more on documentary evidence as opposed to oral or visual evidence. In addition, they may also try to obtain more evidence from third parties instead of just from the client. They may also change the extent of their procedures by increasing their sample size to substantiate values, as well as by performing procedures closer to year end (varying the timing of the audit procedure).

We can see why the planning stage of an audit is very important. Depending on the client, the client’s inherent risk level, and the audit risk level that auditors are willing to tolerate, the scope of audit work can differ substantially. With effective planning, proper implementation, and a skeptical attitude, auditors should be able to uncover most frauds that take place.

- Fraud, misconduct and noncompliance cases ranging from finding simple frauds to complex multi-layer, multi-party, multi-location frauds causing important monetary, functioning and reputational losses to organizations.

- We can extract the importance of fraud, the parties involved in executing the fraud as well as the modus operandi.

- Our advanced forensic technology lab helps us gather this information efficiently and effectively, facilitating analysis to indicate red flags and presenting it in a legally approved format. Wherever relevant, our investigations are aided by covert field operations.

- Exposure to global fraud scenarios

- Best practices in forensic investigation and qualified professionals with multi-domain experience to conclude successful engagement.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex