EPF Registration

EPF Registration

What is EPF Registration?

Employee Provident Fund (EPF) is an initiative to give social benefits to employees; it is a scheme defined under Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 which is regulated by the Employees’ Provident Fund Organization (EPFO).According to this, if the establishment has the strength of more than 20 employees then it is mandatory for the establishment to obtain EIN No. The total strength of employee Includes contractors or temporary employees like housekeeping staff, daily wage worker security or other temporary workers in the business.

Even if a company has employee strength of less than 20 then the company can voluntarily apply for EIN (Employer Identification Number). Company has to obtain EPF registration certificate within 30 days from the date of employment of 20 employees.

Discuss the EPF registration applicability

For following establishments registration is mandatory- Factory having the strength of 20 or more persons engaged in any industry

- Any other establishment having the strength of 20 or more persons or any other establishment which is specified by the Central Government in this behalf.

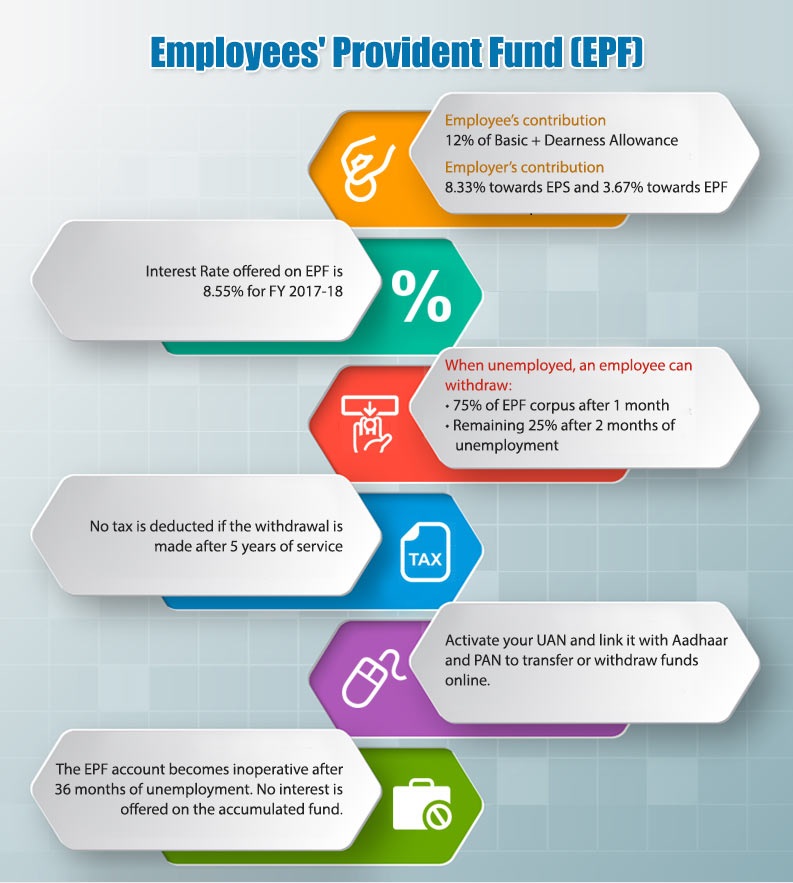

Employer’s contribution = 12% of Basic Wages + Dearness Allowance + Retaining Allowance.

The deduction rate will be 10%, in case of fewer than 20 employees.

What are the documents required for PF registration?

Following documents are required for PF registration

- Copy of PAN Card of firm/company/society/trust.

- Copy of Cancelled cheque (bearing pre-printed company/firm name & Current Account No).

- Partnership Deed (In case of Partnership Firm).

- Certificate of Registration (In case of Proprietorship/ Partnership/ Company / LLP).

- Certificate of Incorporation (In case of company/ society, trust/ NGO).

- Copy of PAN Card of Directors / Partner.

- Copy of Aadhaar Card/ Voter identity card of Director.

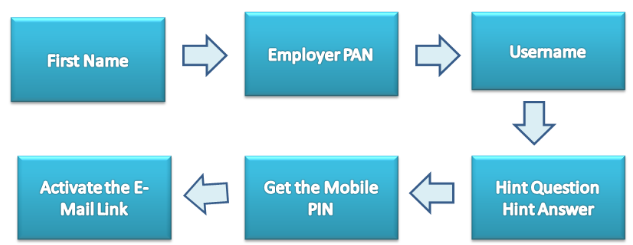

What is the process of EPF registration?

For EPF registration, following below mentioned need to be followedStep 1- Registration with EPFO

For PF registration, one has to visit the website first and there is on the option of “Establishment Registration” on the unified portalStep 2: Read the User Manual

Before the PF registration process, it is important to download and read the instruction manual for the new user. Once you click on the “Establishment Registration” you will get an “Instruction Manual”.Step 3: DSC Registration

For ERF registration, DSC registration is pre-requisite. Registered employers can log in with their credentials like Universal Account Number [UAN] and password. To submit a fresh application, DSC registration is required.Step 4: Fill the Employer’s Details

Who are not to be counted for coverage of a factory?

- A proprietor or a partner

- A contractor lending the services of his employee

- An apprentice engaged under the Apprentice Act, 1961

- Persons employed on contract for professional service legal, technical, tax consultants

How one can check EPF account statement online?

Members of the Employee Provident Fund (EPF) can access their account statement online.Can more than 12% contribution be made in EPF?

Yes, more than 12% contribution be made in EPF and such additional contribution is called ‘voluntary contribution’.What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex