Accounts receivable services

Accounts receivable services

What is Accounts receivable services?

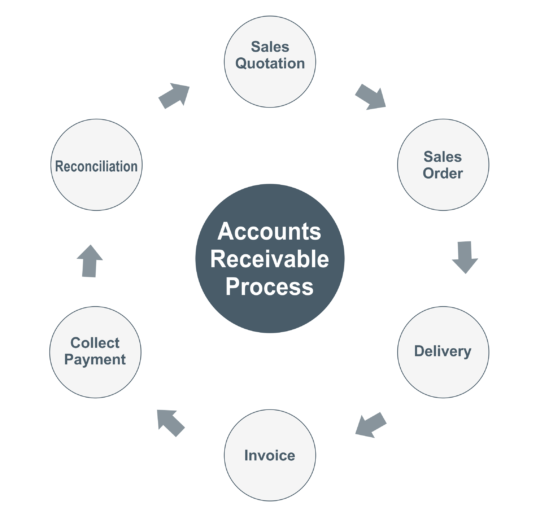

In today's world, where there is neck to neck competition between the companies is going, it is vital for the companies to leverage their resources and bring out the maximum return on investments. Most of the businesses these days are unable to devote their time and resources properly so that they can manage the time and cost carrying debt over the time. For an organization to effectively meet They need a partner to who they can trust and rely upon to help and to improve cash flow by enhancing the company‘s internal accounts receivable department Like Book Keeping. Its goals in terms of cash flow it calls for productive Accounts Receivables process that ensures that companies can get back their payments in a very short span of time, can improve their collection rates and also ensures faster processing of invoices which will contribute towards the cash flow.End-to-End Accounts Receivables Services from PNJ Group

- Sales orders processing

- Bookkeeping

- Invoicing and billing

- Invoice receipt verification

- Invoice reconciliation with payments

- Monthly Open Balance Statements to Customers

- Debtor Aging Report Preparation and Processing

- Payment follow-ups

- Credit Memo processing

- Customer reconciliations

- Credit Control Tools with Continuous Monitoring

- Customer help desk

- Dispute / Chargeback management

- CST C-forms/ GST Form collection

- Bad Debts/ Delinquency Management

- Recovery suites handling

What is Invoicing and Billing?

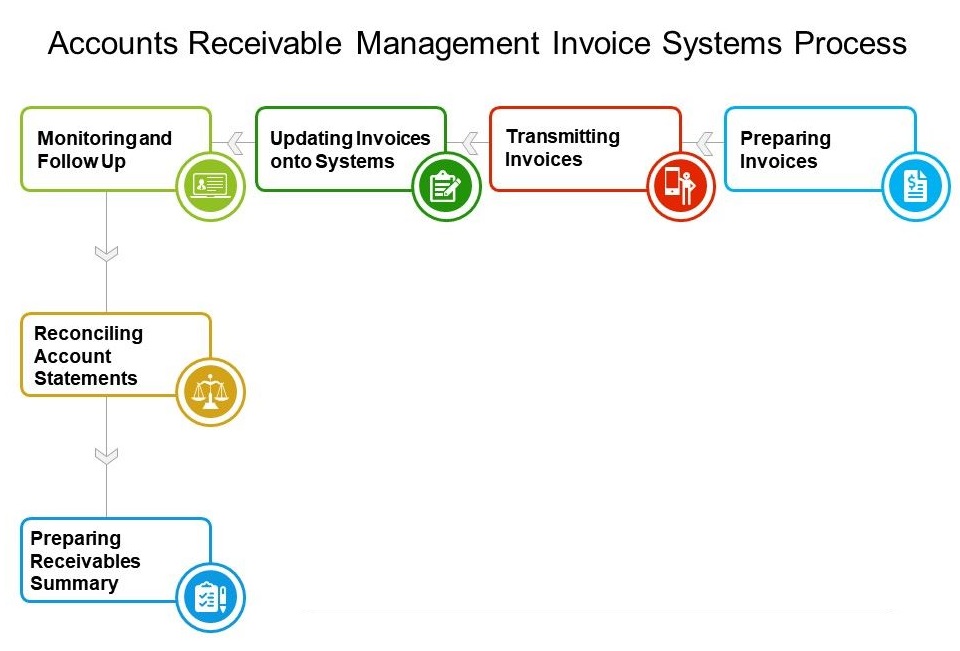

Are your customers paying your invoices in a timely manner? Are your payments delayed by customers due to invoices being missing? Do you have a system to track if invoice reaches to the customer? Let us find a solution and design a seamless workflow to ensure accurate and timely submission of invoices to your customers. The authenticity of your cash flow completely depends on the time management and accurate billing you provide to your customer. An Invoicing is a list of product and services you send to the customer or client which contains the costs they owe to your business.What do we do in Invoicing and Billing?

We do understand the functionalities and capabilities of your accounting ERP and use the best possible way to generate invoices with the relevant information for your customer. A regular billing process is set up to submit invoices to the customer via regular mail or in electronic formats like email, Electronic Data Interface (EDI) or online portal.

Nowadays there are numerous platforms available for the vendors to collaborate with their customers for invoice submission and tracking. Most of the vendors are now available on these portals and made the receivables a seamless process. Let our experienced team help you make use of these innovative ways of billing.

What do we do in Invoice Presentation and Payment?

We actively engage our team of experts who are well versed of billing process on these vendor portals and track the invoices from submission until receipt of payment.What is Customer Accounts Reconciliation?

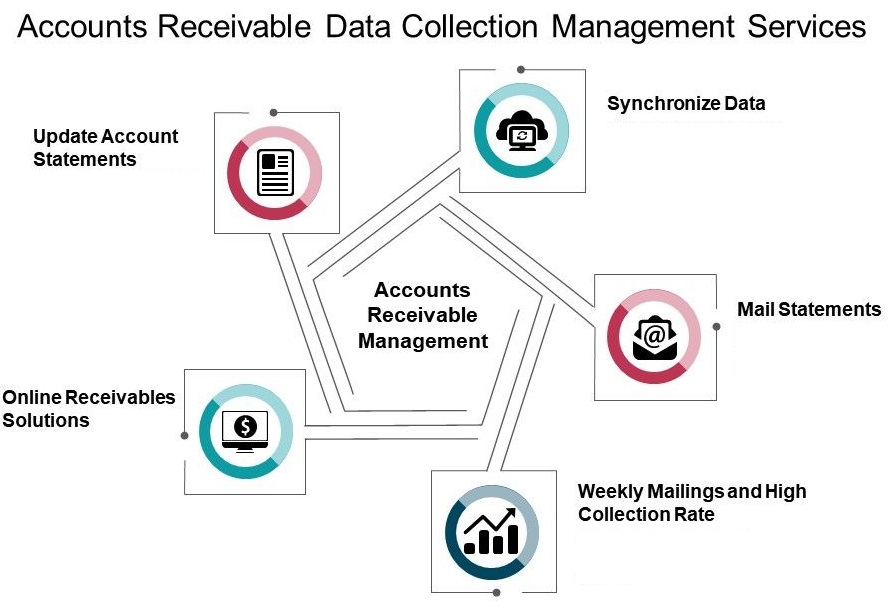

Do you check your receivables frequently and do a regular follow-up so that your customer pays you in time? Are your customers calling for any dispute on late fees, short pays etc.? Let's go a step further to avoid any hassles on payments and reconcile our customers frequently.What do we do in Customer Reconciliation?

We send a statement of accounts to customer periodically to avoid delay in payments. Our dedicated team work closely with the customer's point of contact and updates the accounts.What is Business to Business Collections?

Are your receivable are really past due? Is it a frequent thing happening for your customers? You may need to change your approach connecting with your customers before it gets past due. A past due account is not just the customer's failure; we got to facilitate them and define a strategy to avoid these situations are avoided.What do we do in Business to Business Collections?

A frequent touch-base with your customer for product feedback, charges/services etc help build a rapport. Our team discusses the statement of accounts, share aging of invoice, identifies the cause of the delay, fixes it and creates a process flow with control checks to avoid delays.What is Customer Data Management?

Do you have a large number of customers? We all need correct customer data set-up so that the orders are managed effectively and in a timely manner. How accurate your billing is it would be depending on the customer information available in the accounting ERP system. A correctly updated and managed customer database helps in managing day to day transactions smoothly as well as ensures accuracy taxability as per the applicable taxes in different states.What do we do in Customer Data Management?

We get the required details and tax certificates from your customers while initial set up and keep them updated frequently year after year. We also address the customer requests whenever they want their details updated like a change in name, taxability, nature of business and contact information.

What is Customers Dispute Management?

In order to manage our customers, we have to address their concerns, all kind! Most of the time it is the lack of information or a gap in the process. We can make an unhappy customer a happy customer by mitigating their concerns in a timely fashion.What do we do in Dispute Management?

In the event, a customer delays payment due to any lack of information/returns or breaches the terms of the contract which in turn results in no payment our team of an expert would help resolve the issue mutually and provide all required documentation/backup for clarification and rectification.What is Cash Application?

Cash applications is an important aspect and need to be taken care of with all due care. Your customers try to pay invoices in due time to avoid any late fees and thus the money received shall be applied to the correct invoices.What do we do in Cash Application?

We do ensure that we have a system in place that a remittance advice is received for all customer payments. We do track all payments received in bank via ACH, wire or Check and apply them to the correct invoices.What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex