GIFT City (Gujarat International Finance Tech-City)

The preceding period has seen extraordinary development in India’s fiscal service area and economic segment. Numerous industrialized countries have effectively proven to be become more high-tech commercial hubs, which in excess of time have accommodated as intercontinental financial facilities hubs. This area, which will be an International Financial Services Centre (IFSC), will allow insurers and reinsurers to offer foreign currency policies from India. These hubs deliver appropriate governing regimes and generate a commercial environment to endorse talent and help in the escalation of the capital movement.

GIFT is calculated as a monetary Central Business District (CBD) between two cities Ahmedabad and Gandhinagar in the form of a Greenfield enlargement. GIFT is intended as a pivot for the international monetary facilities sector. The scheme restores the region as high-quality, diversified use district of inhabited, marketable and open space accommodations that improve property and real estate prices.

Following points and more were kept while planning this city:

· High-energy developing blend of Landscape and Technology, augmenting enthusiasm for work & life

· Reduced usage/discernment of energy and bills paid thereof

· Creation of Roof-top green areas

· Non-conformist ways of energy capitals like rain water collecting etc

· Preparation and Design deliberation conferring to micro-climatology.

The IFSC in GIFT is going to be providing abundant profits to the units setting up maneuvers over there. Some of those are stated below:

Infrastructure at par with additional global monetary centers

Liberal tax administration for next 10 years

Robust controlling & legal setting

A solely transparent functioning setting, obeying with worldwide best practices and globally acknowledged commandments and controlling processes

Group of skilled specialists

A contemporary conveyance, infrastructures and internet substructure

Only abode in India which will be allowing international across the border kind of dealings

· All the communications should be in overseas currency (not in Indian Rupee). IFSC elements can transmit out managerial and constitutional expenditures in Indian Rupees.

· The tenancy rent in GIFT Commercial Centre is about Rs. 50 per sq. Ft. to be paid each month. These will be the plug n play elements.

The subsequent securities can be distributed with in the interactions functioning out of the GIFT-IFSC with a quantified interchange lot scope on their transaction platform with their focus upon prior endorsement of SEBI:

Equity shares of a business integrated free standing and not in India

Depository Receipts

Debt Securities distributed by entitled issuers

Currency and interest level results

Index grounded derivatives

Commodities

Byproducts on equity shares of a business integrated in India

Other similar kinds of securities as itemized by SEBI

There is an unmistakable enthusiasm for moving into GIFT City from different money related foundations in view of its framework and cost advantage. Six banks have just demonstrated their enthusiasm for setting up base at GIFT.

1. Process for setting up IFSC Unit in GIFT SEZ-IFSC

Submission of Interest Letter/Mail by the organization for taking up space in incubation facility at GIFT SEZ for setting up unit in GIFT SEZ-IFSC as per the prescribed format.

GIFT SEZ will give the Proposal to the applying organization for taking up space in incubation facility in GIFT SEZ.

The organization to provide the confirmation/acceptance for the Proposal sent by GIFT SEZ.

Post confirmation, GIFT SEZ will issue Provisional Letter of Allotment (PLOA) to the organization for providing office space for setting up IFSC Unit in GIFT SEZ.

Organization to submit application (Form-F) to Development Commissioner, KASEZ for taking approval for setting up IFSC Units in GIFT SEZ along with the relevant documents including PLOA issued by GIFT SEZ.

Simultaneously, application to the concerned Regulator (RBI/SEBI/IRDA) for required license to operate as IFSC Unit in GIFT SEZ under the applicable regulations for banking/capital market /insurance.

On approvals from DC, KASEZ and Regulator, GIFT SEZ to issue Final Letter of Allotment for allocation of space in GIFT SEZ for carrying out the approved operations.

The approved Units shall have to execute lease deed/Leave and License with the Developer or Co –developer as the case may be for the allotted space.

2. Process note for setting up IT/ITeS & other Services Centre in GIFT SEZ

Submission of Interest Letter/Mail by the organization for taking up space at GIFT SEZ for setting up unit in GIFT SEZ as per the prescribed format.

GIFT SEZ will give the Proposal to the applying organization for taking up space in GIFT SEZ.

The organization to provide the confirmation/acceptance for the Proposal sent by GIFT SEZ.

Post confirmation, GIFT SEZ to issue Provisional Letter of Allotment (PLOA) to the organization for providing office space for setting up Unit in GIFT SEZ.

Organization to submit application (Form-F) to Development Commissioner, KASEZ for taking approval for setting up the Unit in GIFT SEZ along with the relevant documents including PLOA issued by GIFT SEZ.

On approvals from DC, KASEZ, GIFT SEZ to issue Final Letter of Allotment for allocation of space in GIFT SEZ for carrying out the approved operations.

The approved Units shall have to execute lease deed/Leave and License with the Developer or Co–developer as the case may be for the allotted space.

Explaining on the fundamental objective behind setting up this one of a kind and first of its kind undertaking, RK Jha, Director-In Charge, Gujarat International Finance Tec-City Company Ltd. Stated that making a Global Financial Hub in India is basic for monetary development which will help bringing more employments and making more business in India. The GIFT venture's objective is to take into account 8-10% of the budgetary administrations potential in India and make 1 million immediate and aberrant employments by creating 90 million square feet of business, private and social offices with amazing personal satisfaction.

We, "PNJ Legal Consultants" are one of the well known organizations engaged in providing Consultancy Services keeping in mind the Client Service Mentality.

We have a team of highly qualified professionals and time to time training is provided by us as per the requirements. Our team members deliver excellent performance in providing these services and our clients can avail the services at affordable prices.

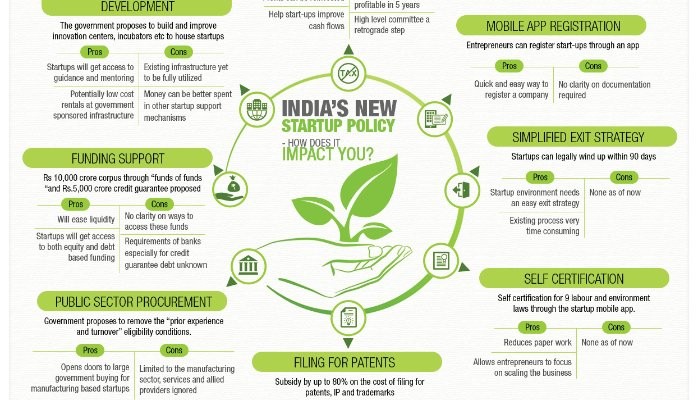

Our sophisticated team has complete knowledge of various exercises and technicalities that are used in our services. Our services includes Strategy Consulting, GST Consulting, Asset Management, Feasibility Study, International Arbitration, Due Dilligence, Franchisee Consulting, Financial Audits, Operational Audits, Real Estate Regulation Act ( RERA) Compliance, Delhi Pollution Control Board complainces, BSE SME IPO Listing, Voluntary Winding Up companies, Strike off Name of companies, Tax Heaven Registrations, Shareholder Agreements, Start up Consulting, Department of Industrial Policy and Promotion ( DIPP) registration and Mergers Acquisitions.

Read Details